As a brand, understanding the financial situation of your customers can help you make sound strategic decisions. On the marketing side, by segmenting your audience based on financial metrics such as income, net worth, and discretionary spending income, you can create targeted messages that speak directly to their needs and desires. This personalized approach can enhance your customer engagement and strengthen their loyalty to your brand. Keep reading to discover how you can leverage financial segmentation to create powerful marketing strategies.

Getting a Baseline

Before you start planning marketing campaigns, your team needs to get a full picture on the financial situation of your customers. We highly recommend creating a Customer Profile Report to comprehensively view your customer’s financial metrics. However, you can also use customer surveys to get an approximate idea of their net income. This information is crucial for two reasons.

The first reason is to support your future marketing segmentation. Whether you feel net income, net worth, or disposable income is the most important metric, we recommend to create low, medium, and high segments. What is considered “low” and “high” will differ depending on your industry and organization. For instance, a luxury clothing brand may consider customers with an annual income of $100k to $150k as “low,” while retailers with a diverse range of products may categorize customers making $25k or less as the lowest tier.

The second reason for pure business intelligence. By comparing your current marketing plan and strategy with the results of your Customer Profile or survey, you can determine if your assumptions about your customers were accurate or not. This insight can drive future marketing and business strategy.

For instance, if you assumed that the average net income of your customers is $1 million a year and built your marketing strategy based on that assumption, you may have invested in advertising on high-end platforms like Forbes or building expensive campaigns on Facebook. However, if your Customer Profile Report reveals that the average net income is actually $100k a year, you would need to re-evaluate your marketing strategy and channels. You might find that your product is suitable for a wider audience than you thought. Alternatively, if you assumed that your average net income was $25k but found it to be $75k, you could leverage this insight to build product bundles that increase the average order value (AOV).

Financial Segmentation Strategies

Depending on your business, industry, and clientele, different financial segments may make more sense to use than others. Here are just three examples, but LaunchPad offers many more segments to choose from. Reach out to us for more information on which segments would be most beneficial for your business.

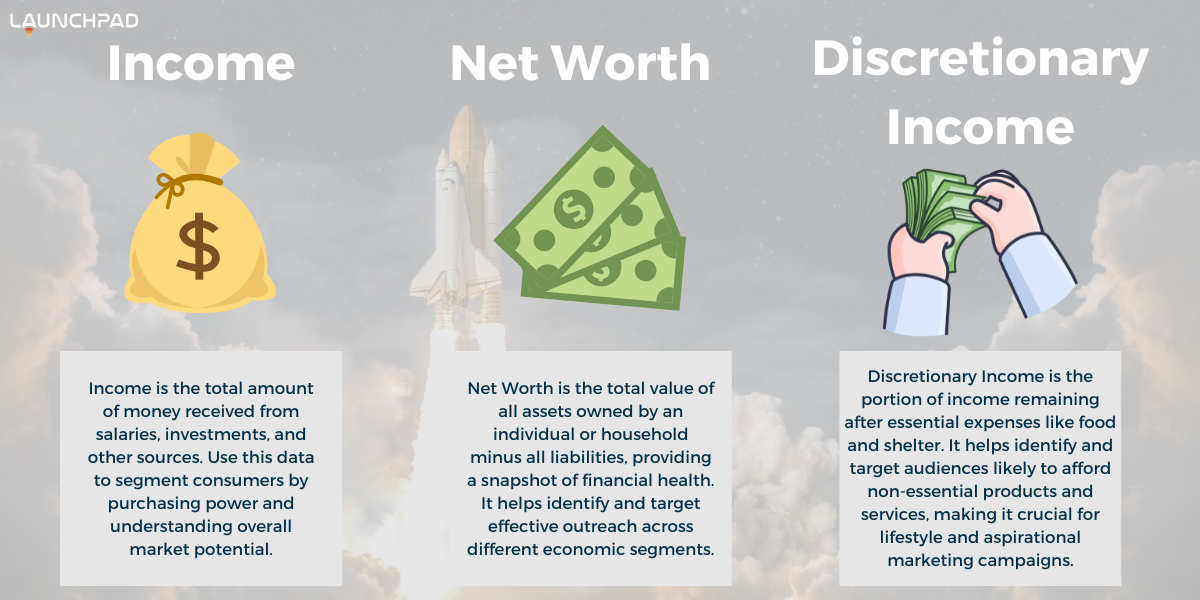

Income

Income is a critical financial metric because it represents the actual earning of individuals or households. Segmenting income involves dividing your target market based on their level of income to create targeted marketing campaigns that appeal to their specific lifestyle.

For example, a fashion retail business can create separate campaigns for their high-end and budget-friendly clothing lines, using visuals and language that convey luxury and exclusivity to high-income customers and affordability and practicality to lower-income customers. By segmenting your market based on income, you can create personalized messages that resonate with your audience and increase engagement and conversion rates.

Net Worth Tiers

Net worth is a reflection of a person’s overall financial health and is an excellent way to segment your customers because people with different levels of net worth often have different priorities and spending habits.

For example, a wealth management firm might target customers with a high net worth, highlighting their ability to provide sophisticated investment strategies, estate planning, and personalized financial advice. On the other hand, a budget-friendly investment platform might target customers with a lower net worth, emphasizing the simplicity, affordability, and accessibility of their platform.

Discretionary Spending Income

Discretionary income segmentation involves dividing your target market based on the amount of money they have left after paying for essential expenses.

For example, a travel company might target customers with a higher discretionary income, promoting luxury vacations, first-class flights, and exclusive experiences. On the other hand, a budget travel company might target customers with a lower discretionary income, emphasizing affordable travel packages, budget-friendly accommodations, and free activities.

This is our favorite. Why? Just because someone has a high net income doesn’t mean they don’t also have a high level of expenses.

Enhancing Financial Segmentation for Better Targeting

While utilizing financial data to segment your audience is a great start, it should be complemented with other segments to create a more accurate picture of your target audience. People’s income alone does not predict their interests, hobbies, or demographics. Therefore, it’s important to enhance your financial segmentation with other segments that are specific to your product or service.

At LaunchPad, we make it easy to create these segments with just a few clicks. The hardest part is figuring out which segments you want to use. But don’t worry, our experienced team can guide you through the process and provide helpful tips along the way.

By combining financial data with other relevant segments, you can create highly targeted marketing campaigns that resonate with your audience’s needs and interests. This approach will help you achieve better engagement, higher conversions, and increased revenue for your business. Contact us today to learn more about our services and how we can help you create effective marketing campaigns.